It seems every time you look around these days there’s an IPO, a startup getting acquired, or a remote startup getting funded. While you can attain some motivation from these examples, it’s important, I think, to realize that these businesses are the exception — not the rule. We started building our business at the end of 2012, and just recently we are starting to get some good traction and growth.

Our current monthly recurring revenue of $11,566 is not a lot of money, because it costs us more than that to develop the product every month. But it’s a very positive start. Neither my co-founder Jared nor I are satisfied with the growth rate of Hubstaff so far, but we have a good idea how to fix it (more features and integrations). It’s a lot of work for a little money upfront — as always. But as you continue pushing day in and day out, good things start to happen.

We’ve learned a lot about software sales with this project, and below are some of the very high-level considerations that you can learn from as you build your businesses.

Consider Market Size and Competition

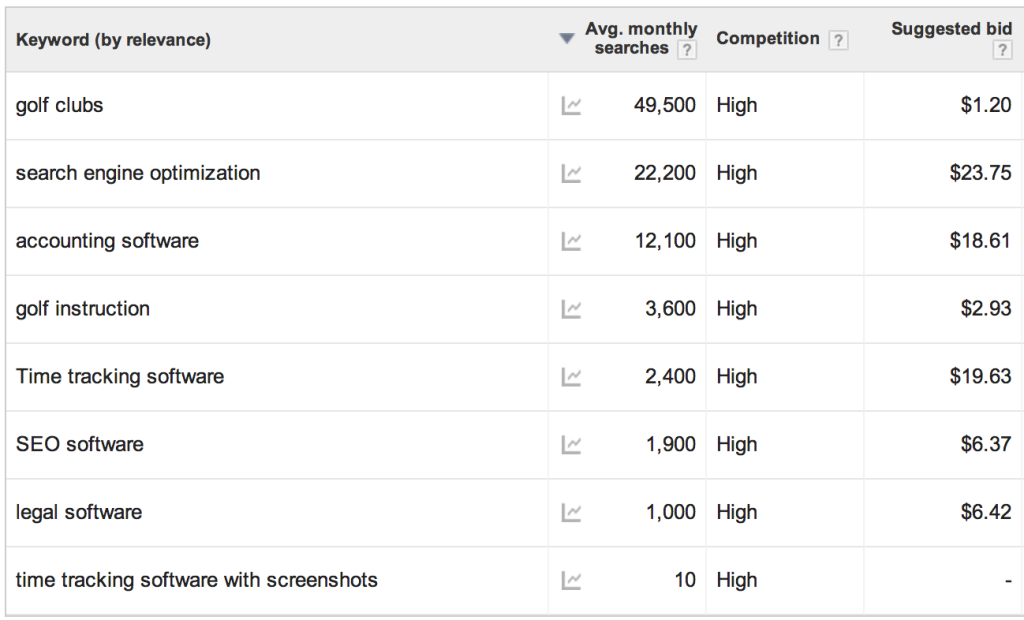

Keyword research is great even if you don’t plan on focusing on SEO or paid media. You can use it to gain a deep understanding of your market and what your potential clients are looking for. There are some keywords here that may seem irrelevant, but they are included so that you can see the differences in market size. When you are looking at keywords you want to think about three high-level things:

- Search Volume: This is how many people are searching for the keywords.

- Long Tail Keywords: This is the variations that people use as they search for a given product. Some have thousands of variations and some have very few. The more, the better.

- Bid Price: This allows you to understand what others are paying for the keywords. You can combine this with volume stats to get some interesting metrics.

Our market is primarily “time tracking software.” There are a lot of competitors in that space and relatively low search volumes. This is something that I wish we would have paid more attention to early on. Market size has definitely been a limiting factor on Hubstaff so far, and based on the numbers above, you can probably understand that selling accounting software may be more lucrative than time tracking software based solely on the numbers. It’s approximately four times the size in searches.

But at Hubstaff, we aren’t just time tracking software. We have screenshots, activity levels, and other similar features that allow our software to stand out. But the question is how many people are really searching for time tracking software with these features? According to the data above, not many…

The most important aspect of a startup is probably the market you build in. It can have the most profound impact on your success with the least effort (you have to take all you can get). You can see that in the example above. “Golf clubs” has a lot of searches and a low bid price. But you also need to consider competition and barrier to entry.

Consider Product Price

People underestimate how hard it is to really get traction when you are talking about charging an average of $27 a month. That’s not a lot of money, and it contributes greatly to our overall revenue growth numbers. Here’s where we are at right now in terms of monthly recurring revenue and current customers:

If you do the math, it ends up being around $27 per subscription. That’s the core issue. We charge $5 a user and our average client has around five users. For our current technology, $5 a user seems to be acceptable for most clients. By contrast, check out what KISSmetrics charges:

This type of pricing is pretty typical for the analytics industry. We eventually landed on Mixpanel over KISSmetrics because they allowed us to get the product for free by putting a badge in our footer. But just think about how much faster the revenue would add up.![]()

Consider the Size of the Client

Most of our clients are smaller in size. They have around three to 10 people on their team. That means that if you look at the average client in the above example, they are most likely somewhat cost-conscious.

Compare this to a business like Baremetrics, which is mostly dealing with clients that are well established and cash positive. Baremetrics provides metrics for businesses like Buffer and other companies that use Stripe as their payment processor. Baremetrics has an open policy, and they inspired us to do the same. You can see their live numbers here.

Think about this on a deep level for a minute and you’ll see the important lesson. The Baremetrics product appeals ONLY to businesses that have gotten to the point of integrating the Stripe payment processor into their software app and have payments coming in. If they didn’t have payments coming in, then they wouldn’t need metrics.

Many clients who are just getting started use Hubstaff, on the other hand. Maybe they are building a new app or they are starting an agency. They may not even have a client yet. But we still wouldn’t trade our business for the world. There are positives that greatly outweigh the negatives, such as barrier to entry for the product, a growing industry, the viral coefficient and more. The goal here is simply to look back at a high level on some of the things we would have considered closer before we started.

If you’ve already built a software business, what other considerations would you recommend entrepreneurs consider? Please leave your comments below.

This post originally appeared on the Hubstaff blog.